Food Pantry Tax Credit Doubles Your Giving

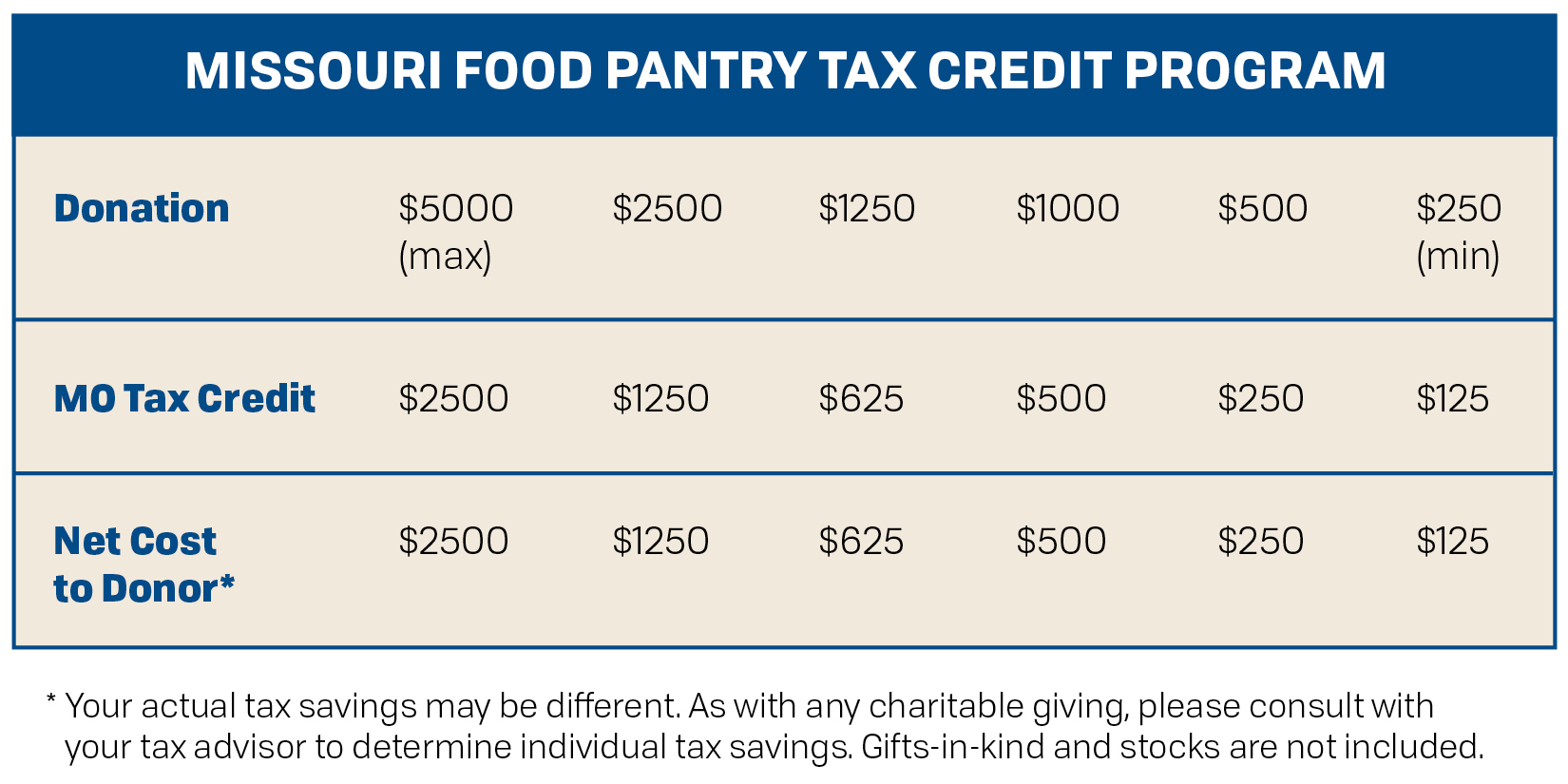

You can make your donation to Caritas Connections go further by taking advantage of the Missouri Food Pantry Tax Credit program that allows an individual, corporation, or trust to receive up to 50% of their gift back through a state of Missouri tax credit. The maximum value of the credit is $2,500 for an individual or $5,000 if filing jointly.

This credit is equal to 50% of the donation amount to a maximum of $2,500 per tax year, per taxpayer. If married individuals filing jointly donate, each spouse may claim up to $2,500. Gifts-in-kind, stock donations, and gifts from Donor Advised Funds do not qualify for the credit. Only direct cash donations are eligible.

If you make a donation of $250 or more before December 31, 2024, Caritas Connections will mail you a tax form in February 2025. This form must be submitted with your state tax return along with a completed Miscellaneous Income Tax Credits Form (MO-TC) by the filing deadline (no extensions beyond April 15, 2025). So, if you double your typical donation, Caritas receives all of it and you can get up to half of it back in tax credits!

Caritas Connections is grateful to be able to offer the MFPTC to our donors. However, we cannot give tax advice. Please reach out to your accountant or tax service with questions related to your specific financial situation. Additional information about the MFPTC can also be found here: https://dor.mo.gov/tax-credits/fpt.html.

6 Common Questions About the MFPTC

1. What is the MFPTC?

The Missouri Food Pantry Tax Credit incentivizes Missouri taxpayers to donate to their favorite food pantries each year. By making a donation to Caritas Connections, an individual, corporation, or trust can receive up to 50% of their gift back through a state tax credit. The maximum value of the credit is $2,500 for an individual or $5,000 if filing jointly.

2. Are there any exclusions to receiving the MFPTC?

Gifts-in-kind, stock donations, and gifts from Donor Advised Funds do not qualify for the credit. Only direct cash donations are eligible.

3. I have made a cash donation to Caritas Connections in 2024. What happens next?

All gifts received by year-end may be eligible for the credit. If you make a donation of $250 or more before December 31, 2024, Caritas Connections will send you a tax form in the mail in February 2025. This form must be submitted with your state tax return along with a completed Miscellaneous Income Tax Credits Form (MO-TC) by the filing deadline (no extensions beyond April 15, 2025). Filing for the tax credit makes your donation go further in our efforts to help the poor and underserved in the metro St. Louis area.

If you are a Missouri resident and make a gift of less than $250 you can reach out to treasurer@caritasconnections.com after February 1, 2025, to request the MFPTC form be sent to you.

4. I plan to file an extension for my taxes in the coming year. Am I eligible for the MFPTC?

Unfortunately, the state is very strict on filing deadlines. You must file your 2024 Missouri taxes by April 15, 2025, in order to be eligible for the credit. If you file them later, you will be eligible to apply the tax credit to a future tax year.

5. Am I guaranteed the MFPTC?

The State of Missouri apportions $1,750,000 into the MFPTC program each year. MFPTC claims will be held by the Missouri Department of Revenue until after all returns received on April 15 have been processed to determine if the total amount claimed exceeds $1,750,000. If claims exceed $1,750,000, the Department will apportion credits in an equal ratio among all valid returns filed. Any remaining credit from an applicant can be applied to future tax years.

6. I have additional questions related to my specific tax situation. Can you help?

Caritas Connections is grateful to be able to offer the MFPTC to our donors. However, we cannot give tax advice. Please reach out to your accountant or tax service with questions related to your specific financial situation. Additional information about the MFPTC can also be found here: https://dor.mo.gov/tax-credits/fpt.html. You may also call the Missouri Taxation Division at (573) 751-3220 or e-mail: taxcredit@dor.mo.gov.

If you have any other questions, please email treasurer@caritasconnections.com.